Post by @Barchart

73% credible (78% factual, 64% presentation). The claim of $395 billion in unrealized losses for US banks in Q2 2025 is accurately sourced from FDIC data, representing a slight decrease from previous peaks. However, the presentation's 'BREAKING' framing and omission of the unrealized nature of these losses exaggerate urgency and misrepresent the current banking stability context.

Analysis Summary

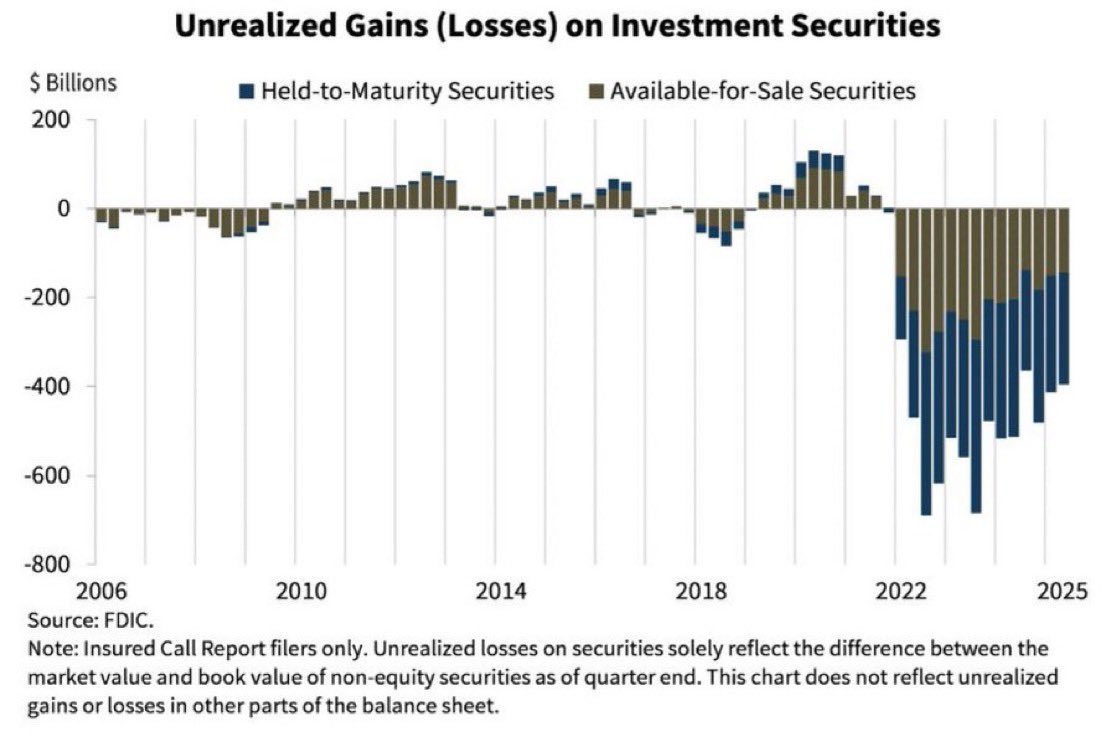

The post highlights significant unrealized losses in US banks' investment securities totaling $395 billion as of Q2 2025, based on FDIC data. This figure represents a slight decrease from prior quarters but remains a concern for banking stability amid high interest rates. Accompanying chart illustrates historical trends showing peaks in losses during 2022-2025.

Original Content

The Facts

The claim aligns with FDIC reports and multiple financial analyses confirming $395 billion in unrealized losses for Q2 2025, down from higher peaks like $517 billion in 2024. While the data is accurate, the 'BREAKING' framing may exaggerate urgency as losses have stabilized. Verdict: True

Benefit of the Doubt

The post advances a cautionary perspective on banking vulnerabilities to alert investors and traders to potential risks in the financial sector, using dramatic language like 'BREAKING' to drive engagement. It emphasizes the scale of losses to shape perceptions of economic fragility, but omits key context such as the unrealized nature of these losses (not requiring immediate write-downs) and recent declines from 2022 peaks, potentially overstating imminent threats. This selective presentation may foster heightened market anxiety without balanced discussion of mitigating factors like regulatory oversight.

Visual Content Analysis

Images included in the original content

VISUAL DESCRIPTION

A bar chart depicting unrealized gains and losses on investment securities from 2006 to 2025, with blue bars for Held-to-Maturity securities and brown bars for Available-for-Sale securities. The y-axis ranges from +200 to -800 billion dollars, x-axis shows years in two-year increments. Losses deepen significantly from 2022 onward, reaching approximately -395 billion in 2025.

TEXT IN IMAGE

$Billions Unrealized Gains (Losses) on Investment Securities Held-to-Maturity Securities Available-for-Sale Securities Source: FDIC. Note: Insured Call Report filers only. Unrealized losses on securities solely reflect the difference between the market value and book value of non-equity securities as of quarter end. This chart does not reflect unrealized gains or losses in other parts of the balance sheet.

MANIPULATION

No signs of editing, inconsistencies, or artifacts; appears to be a standard, unaltered financial chart from a credible source.

TEMPORAL ACCURACY

The chart extends to 2025, aligning with Q2 2025 data, and matches recent FDIC reports from September 2025; current date is November 2025, confirming recency.

LOCATION ACCURACY

No specific locations depicted; the content is abstract financial data without geographical elements.

FACT-CHECK

The chart accurately represents FDIC-sourced data on unrealized losses, corroborated by multiple sources including FAU analysis and St. Louis Fed reports showing $395 billion for Q2 2025, with losses steady or slightly reduced.

How Is This Framed?

Biases, omissions, and misleading presentation techniques detected

The use of 'BREAKING' creates a sense of novel crisis for data that reflects quarterly reporting on stabilized losses, not an acute event.

Problematic phrases:

"BREAKING"What's actually there:

Routine quarterly FDIC report release

What's implied:

Sudden, unfolding emergency

Impact: Leads readers to perceive imminent banking collapse rather than ongoing, managed risk, heightening unnecessary anxiety.

Fails to mention that losses are unrealized (paper losses not requiring immediate action) and have decreased from $517 billion peak, altering interpretation from crisis to stabilization.

Problematic phrases:

"sitting on $395 Billion in unrealized losses"What's actually there:

Unrealized losses down 24% from 2024 peak; no immediate write-downs needed per regulations

What's implied:

Active, mounting financial distress threatening stability

Impact: Misleads readers into overestimating systemic risk, potentially influencing investment decisions toward undue caution.

Omits mitigating factors like strong regulatory oversight, capital buffers, and historical recovery from similar unrealized losses post-2022 rate hikes.

Problematic phrases:

"U.S. Banks are now sitting on $395 Billion"What's actually there:

Banks hold $2.9 trillion in capital; losses peaked in 2022 but have trended down amid rate stabilization

What's implied:

Unaddressed vulnerability without safeguards

Impact: Fosters one-sided view of fragility, amplifying fear without balanced perspective on resilience.

Presents $395 billion in isolation without comparing to total U.S. bank assets ($23+ trillion) or securities portfolio size, exaggerating relative impact.

Problematic phrases:

"$395 Billion in unrealized losses"What's actually there:

Losses represent ~1.7% of total bank assets

What's implied:

Overwhelming burden relative to bank health

Impact: Readers undervalue the sector's overall scale, perceiving losses as more crippling than they are.

Sources & References

External sources consulted for this analysis

https://www.reddit.com/r/EconomyCharts/comments/1ngjstw/us_banks_are_now_sitting_on_395_billion_in/

https://business.fau.edu/departments/finance/banking-initiative/unrealized-losses-investment-securities/

https://voice.lapaas.com/us-banks-unrealized-losses-q2-2025-395-billion/

https://www.fau.edu/newsdesk/articles/concerns-banking-stability-unrealized-losses

https://www.fau.edu/newsdesk/articles/concerns-banking-stability-unrealized-losses.php

https://www.financialresearch.gov/the-ofr-blog/2025/05/15/the-state-of-banks-unrealized-securities-losses/

https://coinpost.ai/en/topics/67746

https://voice.lapaas.com/us-banks-unrealized-losses-q2-2025-395-billion/

https://www.stlouisfed.org/on-the-economy/2025/nov/banking-analytics-unrealized-losses-decrease-again-us-banks

https://www.threads.com/@fluent.in.finance/post/DP6WZl1Ecka/us-banks-are-now-sitting-on-395-billion-in-unrealized-losseswho-remembers-when-b

https://www.ainvest.com/news/bloomberg-banks-sitting-395-billion-unrealized-losses-mark-market-write-downs-bonds-securities-2510/

https://seekingalpha.com/news/4489219-us-banks-trim-paper-losses-to-395b-in-q2-fdic-says

https://www.bloomberg.com/news/articles/2025-09-04/smaller-banks-tackle-395-billion-bond-headache-with-share-sales

https://x.com/Barchart/status/1966982715234021728

https://x.com/Barchart/status/1984067074495541608

https://x.com/Barchart/status/1974570878110245266

https://x.com/Barchart/status/1803858652329078966

https://x.com/Barchart/status/1928262650309341658

https://x.com/Barchart/status/1938743959267774773

https://coinpost.ai/en/topics/67746

https://www.reddit.com/r/EconomyCharts/comments/1ngjstw/us_banks_are_now_sitting_on_395_billion_in/

https://www.financialresearch.gov/the-ofr-blog/2025/05/15/the-state-of-banks-unrealized-securities-losses/

https://www.fdic.gov/news/speeches/2025/fdic-quarterly-banking-profile-second-quarter-2025

https://www.fau.edu/newsdesk/articles/concerns-banking-stability-unrealized-losses.php

https://business.fau.edu/departments/finance/banking-initiative/unrealized-losses-investment-securities/

https://www.fau.edu/newsdesk/articles/concerns-banking-stability-unrealized-losses

https://coinpost.ai/en/topics/67746

https://voice.lapaas.com/us-banks-unrealized-losses-q2-2025-395-billion/

https://www.stlouisfed.org/on-the-economy/2025/nov/banking-analytics-unrealized-losses-decrease-again-us-banks

https://www.threads.com/@fluent.in.finance/post/DP6WZl1Ecka/us-banks-are-now-sitting-on-395-billion-in-unrealized-losseswho-remembers-when-b

https://www.ainvest.com/news/bloomberg-banks-sitting-395-billion-unrealized-losses-mark-market-write-downs-bonds-securities-2510/

https://seekingalpha.com/news/4489219-us-banks-trim-paper-losses-to-395b-in-q2-fdic-says

https://www.bloomberg.com/news/articles/2025-09-04/smaller-banks-tackle-395-billion-bond-headache-with-share-sales

https://x.com/Barchart/status/1966982715234021728

https://x.com/Barchart/status/1984067074495541608

https://x.com/Barchart/status/1974570878110245266

https://x.com/Barchart/status/1752842835164835880

https://x.com/Barchart/status/1803858652329078966

https://x.com/Barchart/status/1867444831481426421

Want to see @Barchart's track record?

View their credibility score and all analyzed statements