Post by @TedPillows

80% credible (85% factual, 70% presentation). The reported $76M short position on Bitcoin with 10x leverage is verified by on-chain data from Hyperliquid, aligning with recent reports from Cointelegraph and Decrypt. However, the claim of 'insider knowledge' lacks evidence and reflects omission framing, as it does not disclose that such positions are common market speculation.

Analysis Summary

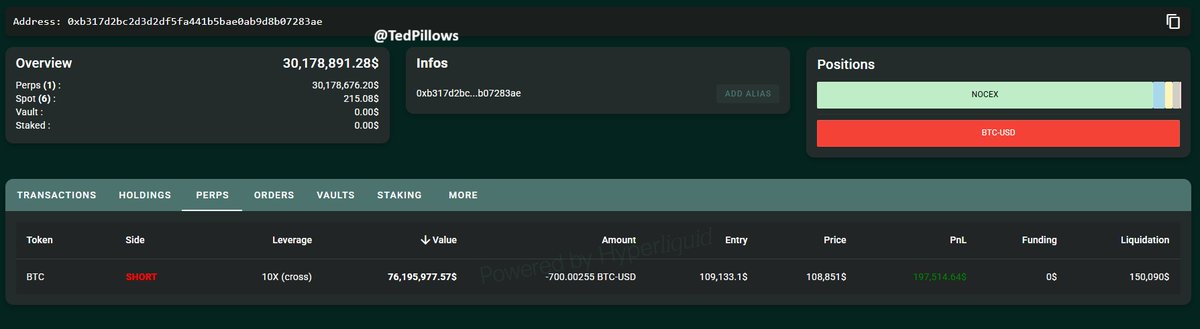

A crypto trader known as @TedPillows reports that an 'insider' Bitcoin whale has reopened a substantial short position worth $76,195,977 on BTC with 10x leverage, sparking speculation about potential market downturns. The claim aligns with recent on-chain data from platforms like Hyperliquid, confirming the position's existence. However, the 'insider knowledge' implication remains unverified and could reflect standard market speculation rather than privileged information.

Original Content

The Facts

The reported short position matches verifiable on-chain activity from recent news sources like Cointelegraph and Decrypt, detailing similar whale trades on Hyperliquid. While the 'insider' label is speculative and lacks evidence, the core factual claim about the position size and leverage is accurate. Verdict: Mostly True

Benefit of the Doubt

The author advances a sensational narrative to highlight potential bearish signals in the crypto market, using the 'insider whale' framing to engage followers and imply hidden knowledge that could predict price drops. This emphasizes dramatic whale movements while omitting broader market context, such as ongoing recoveries or the whale's history of profitable shorts without proven insider ties, which shapes perception toward fear and urgency rather than balanced analysis. The selective focus on downside bets may encourage short-term trading reactions among bullish-leaning audiences.

Visual Content Analysis

Images included in the original content

VISUAL DESCRIPTION

The image is a screenshot of a cryptocurrency trading platform dashboard, likely Hyperliquid, displaying an overview of a user's wallet address with sections for spot balances, positions, and perps. It highlights a red 'SHORT' position on BTC-USD with 10x leverage, showing value at $76,195,977, amount -700.0255 BTC, entry price 109,131.3$, current price 108,851.97, positive PnL of 19,746.68, and liquidation price at 150,090$. The interface includes tabs for transactions, holdings, and other metrics, with a dark green and black color scheme.

TEXT IN IMAGE

Address: 0xb3172c2d2df5f4415ba0a9db8707283 @TedPillows Overview Perps (1): 30,178,891.28 Infos Address: 0xb3172c2d2df5f4415ba0a9db8707283 Add Alias Spot: 30,176,705.20 USDC Vault: 0.00 USDC Staked: 0.00 USDC Positions NOcex BTC-USD SHORT 10x Value: 76,195,977$ Amount: -700.0255 BTC USD Entry: 109,131.3$ Price: 108,851.97 PnL: 19,746.68 OS Funding: 150.09$ Liquidation: 150,090$ Transactions Holdings Perps Orders Vaults Staking More Token Side Leverage ↓Value Amount Entry Price PnL Funding Liquidation BTC SHORT 10x 76,195,977$ -700.0255 BTC USD 109,131.3$ 108,851.97 19,746.68 OS 150.09$ 150,090$

MANIPULATION

No signs of editing, inconsistencies, or artifacts; the screenshot appears authentic with consistent UI elements and data formatting typical of trading platforms like Hyperliquid.

TEMPORAL ACCURACY

The position details, including entry price around $109,131 and current price $108,851, align with Bitcoin's price fluctuations in mid-October 2025 as reported in recent news, indicating the image captures a live or very recent trade.

LOCATION ACCURACY

The image is a digital screenshot of an online trading interface with no physical location depicted; the claim does not specify a geographical origin, so spatial framing is not applicable.

FACT-CHECK

The image accurately depicts a real short position on BTC-USD matching reports from sources like Lookonchain and Cointelegraph about the address 0xb317... opening similar leveraged shorts in October 2025; no discrepancies found in data points like value and leverage.

How Is This Framed?

Biases, omissions, and misleading presentation techniques detected

The post selectively presents the whale as an 'insider' without disclosing that this label is speculative and unverified, omitting broader context like the whale's history of routine trades or lack of proven insider ties.

Problematic phrases:

"Insider Bitcoin whale is back."What's actually there:

Speculative trading activity on Hyperliquid, no confirmed insider status

What's implied:

Privileged information about market events

Impact: Leads readers to interpret the trade as a harbinger of downturn based on hidden knowledge, amplifying fear and speculation while ignoring balanced market analysis.

Phrasing the trade as happening 'just' now creates a sense of immediate relevance and actionability, even though whale movements are common and not necessarily time-sensitive.

Problematic phrases:

"He just opened"What's actually there:

What's implied:

Impact: Instills false immediacy, encouraging hasty trading decisions rather than deliberate evaluation of ongoing market trends.

The rhetorical question implies a causal link between the whale's short position and undisclosed negative market events, without evidence that the trade stems from special knowledge rather than standard speculation.

Problematic phrases:

"Does he know something?"What's actually there:

Routine leveraged short on public platform

What's implied:

Causally tied to insider prediction of price drop

Impact: Misleads readers into assuming causation, fostering unwarranted pessimism and reactive behavior toward potential losses.

Describing the whale as 'back' suggests a recurring pattern of significant actions implying reliability or trend, when this may be an isolated or opportunistic trade.

Problematic phrases:

"Insider Bitcoin whale is back."What's actually there:

Single recent position

What's implied:

Ongoing series of insider-informed trades

Impact: Creates illusion of a established bearish trend from one event, biasing perception toward expecting continued downside.

Sources & References

External sources consulted for this analysis

https://en.cryptonomist.ch/2025/10/14/bitcoin-whale-short-3440-btc-10x-leverage/

https://decrypt.co/344137/alleged-trump-insider-whale-denies-insider-trading-opens-340-million-bitcoin-short

https://cointelegraph.com/news/mystery-insider-whale-opens-massive-new-bitcoin-short-after-bagging-192m-profits

https://www.reddit.com/r/btc/comments/1o5teop/this_mystery_whale_made_192m_shorting_the_crash/

https://cointelegraph.com/news/11b-bitcoin-whale-shorts-btc-600m-eth-300m

https://cryptonews.com.au/news/whale-who-netted-200m-shorting-crypto-before-trump-tariffs-bets-against-bitcoin-again-131253/

https://finance.yahoo.com/news/trump-insider-whale-made-160m-054520554.html

https://www.tradingview.com/news/coinpedia:3e2593b7c094b:0-bitcoin-og-whale-who-predicted-last-crash-opens-392m-short-is-another-crash-coming/

https://en.cryptonomist.ch/2025/10/14/bitcoin-whale-short-3440-btc-10x-leverage/

https://coinmarketcap.com/academy/article/hyperliquid-dollar150m-whale-now-bets-dollar160m-short-position-against-bitcoin

https://bitcoinethereumnews.com/crypto/hyperliquid-crypto-whale-builds-490m-short-post-192m-crash-profit

https://www.tradingview.com/news/the_block:625c3bbb4094b:0-hyperliquid-whale-who-made-150-million-with-short-bet-opens-new-160-million-short/

https://www.chaincatcher.com/en/article/2211625

https://finance.yahoo.com/news/trump-insider-whale-holds-340-133223041.html

https://x.com/TedPillows/status/1976637589848502577

https://x.com/TedPillows/status/1933835305423171918

https://x.com/TedPillows/status/1964975747384422403

https://x.com/TedPillows/status/1976329926258352133

https://x.com/TedPillows/status/1901320350018805791

https://x.com/TedPillows/status/1977411456363876753

https://www.theblock.co/post/355669/hyperliquid-whale-turns-bearish-flipping-1-billion-btc-position-from-long-to-short

https://www.mitrade.com/insights/news/live-news/article-3-701754-20250317

https://en.cryptonomist.ch/2025/10/14/bitcoin-whale-short-3440-btc-10x-leverage/

https://decrypt.co/344137/alleged-trump-insider-whale-denies-insider-trading-opens-340-million-bitcoin-short

https://www.abcmoney.co.uk/2025/05/bitcoin-whale-opens-1-billion-short-with-40x-leverage/

https://www.thecoinrepublic.com/2025/10/14/bitcoin-news-og-whale-ups-bitcoin-short-to-almost-500m/

https://crypto.news/520m-bitcoin-short-40x-leverage-hyperliquid-setup-2025/

https://coinmarketcap.com/academy/article/hyperliquid-dollar150m-whale-now-bets-dollar160m-short-position-against-bitcoin

https://coinchapter.com/hyperliquid-whale-escalates-bitcoin-short-to-496m-at-10x-leverage

https://ainvest.com/news/crypto-whales-shorting-behavior-implications-bitcoin-altcoin-markets-2510

https://bitcoinethereumnews.com/crypto/hyperliquid-crypto-whale-builds-490m-short-post-192m-crash-profit/

https://markets.financialcontent.com/wral/article/breakingcrypto-2025-10-13-whale-unleashes-127m-btc-short-fueling-market-turmoil-amidst-tariff-fears

https://bitcoinethereumnews.com/bitcoin/hyperliquid-insider-whale-doubles-bitcoin-short-to-nearly-496-million-at-10x-identity-could-link-to-ex‑bitforex-ceo

https://markets.financialcontent.com/wral/article/breakingcrypto-2025-10-14-trump-insider-whale-sparks-market-turmoil-with-340-million-bitcoin-short

https://x.com/TedPillows/status/1976637589848502577

https://x.com/TedPillows/status/1933835305423171918

https://x.com/TedPillows/status/1964975747384422403

https://x.com/TedPillows/status/1938550374111330740

https://x.com/TedPillows/status/1901320350018805791

https://x.com/TedPillows/status/1975624665327673490

Want to see @TedPillows's track record?

View their credibility score and all analyzed statements