Post by @FluentInFinance

87% credible (91% factual, 79% presentation). The claim of $395 billion in unrealized losses for U.S. banks is accurate based on FDIC data as of late 2025, but the comparison to the 2008 financial crisis is misleading due to differences in banking regulations and the nature of unrealized losses. The post's credibility is reduced by omission framing that fails to mention unrealized losses do not immediately impact bank balance sheets.

Analysis Summary

The post highlights that U.S. banks are facing over $395 billion in unrealized losses on investment securities, drawing a parallel to the 2008 financial crisis where banks were bailed out after risky gambles. This figure aligns with recent FDIC data showing significant losses peaking in recent years. However, the comparison overlooks key differences in banking regulations and the nature of unrealized versus realized losses.

Original Content

The Facts

The claim about $395 billion in unrealized losses is accurate based on recent Bloomberg and FDIC reports as of late 2025, though the 2008 comparison is somewhat misleading as current losses are unrealized and banks have stronger capital requirements post-Dodd-Frank, reducing immediate bailout risks.

Benefit of the Doubt

The author advances an alarmist perspective on banking stability to engage readers and promote financial awareness, emphasizing historical parallels to evoke concern about potential economic fallout. Key omissions include the fact that unrealized losses do not directly impact balance sheets unless securities are sold, and post-2008 reforms have made the system more resilient. This selective framing shapes perception toward viewing banks as perpetually risky, potentially driving newsletter subscriptions without fully contextualizing the lower systemic threat compared to 2008.

Visual Content Analysis

Images included in the original content

VISUAL DESCRIPTION

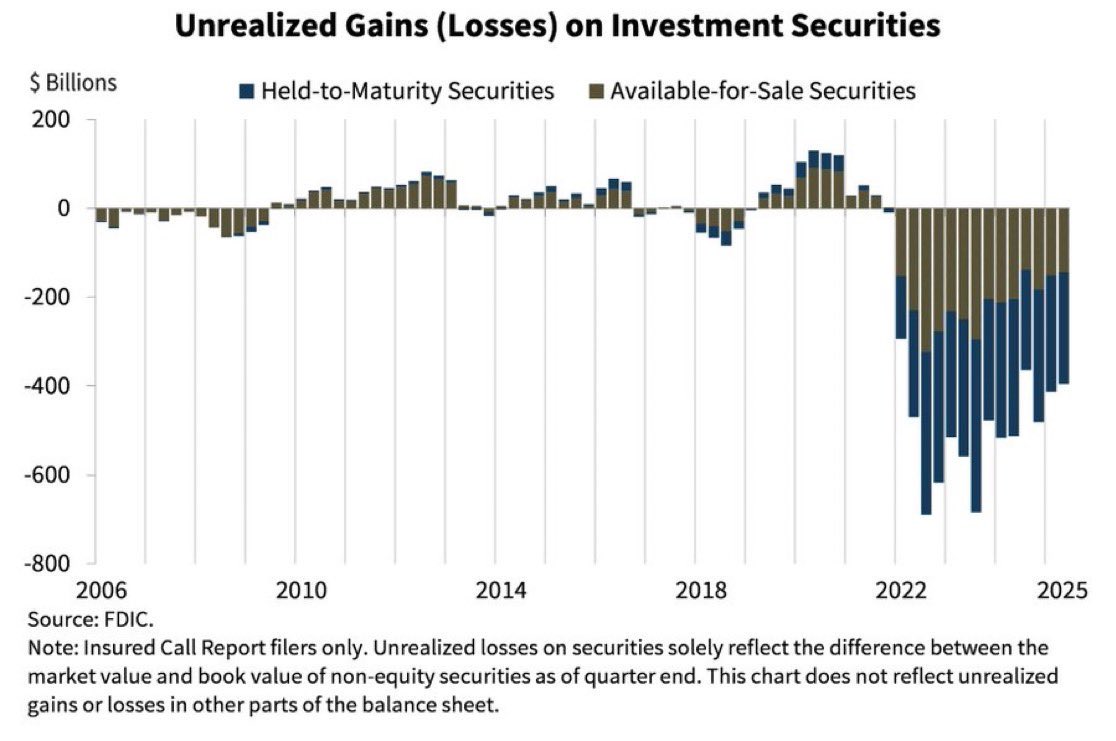

A bar chart displaying unrealized gains and losses on investment securities for U.S. banks from 2006 to 2025, with blue bars for Held-to-Maturity securities and brown bars for Available-for-Sale securities. The y-axis ranges from +200 to -800 billion dollars, showing mostly small fluctuations until sharp declines starting in 2022, reaching approximately -700 to -800 billion in losses by 2025.

TEXT IN IMAGE

$ Billions Unrealized Gains (Losses) on Investment Securities Held-to-Maturity Securities Available-for-Sale Securities 200 -100 0 -200 -300 -400 -600 -800 2006 2010 2014 2018 2022 2025 Source: FDIC. Note: Insured Call Report filers only. Unrealized losses on securities solely reflect the difference between the market value and book value of non-equity securities as of quarter end. This chart does not reflect unrealized gains or losses in other parts of the balance sheet.

MANIPULATION

No signs of editing, inconsistencies, or artifacts; the chart appears to be a standard, unaltered visualization from official FDIC data.

TEMPORAL ACCURACY

The chart extends to 2025, aligning with the current date of October 2025, and reflects recent quarter-end data as per FDIC reports.

LOCATION ACCURACY

The chart pertains to U.S. banks via FDIC data, directly matching the post's claim about U.S. banking sector losses with no geographical discrepancies.

FACT-CHECK

The chart accurately depicts FDIC-sourced data on unrealized losses, corroborated by reports showing around $395 billion in total losses as of Q3 2025, though the exact peak may vary slightly by quarter; no misleading scales, but it focuses solely on securities without broader balance sheet context.

How Is This Framed?

Biases, omissions, and misleading presentation techniques detected

The post omits that unrealized losses do not immediately affect bank balance sheets unless securities are sold, and post-Dodd-Frank regulations have strengthened capital requirements, reducing bailout likelihood compared to 2008.

Problematic phrases:

"U.S. Banks are now sitting on $395+ Billion in unrealized losses""Who remembers when Banks gambled away our economy in 2008 but then got bailed out?"What's actually there:

Unrealized losses accurate per late 2025 reports, but non-immediate threat due to regulations

What's implied:

Imminent crisis similar to 2008 realized losses and gambles

Impact: Leads readers to perceive current banking situation as acutely dangerous and bailout-prone, inflating perceived economic risk without balanced context.

The $395B figure is accurate but framed against 2008's realized losses and systemic collapse, misleadingly equating scales without noting differences in loss type and regulatory safeguards.

Problematic phrases:

"$395+ Billion in unrealized losses""Banks gambled away our economy in 2008"What's actually there:

$395B unrealized (2025 FDIC data); 2008 involved $700B+ realized subprime losses

What's implied:

Current losses as equivalently catastrophic as 2008

Impact: Exaggerates the magnitude of threat by poor comparative scaling, making readers overestimate systemic vulnerability.

Presenting ongoing unrealized losses as an immediate 'now' crisis with a rhetorical question linking to past bailout evokes false immediacy.

Problematic phrases:

"are now sitting on""Who remembers..."What's actually there:

Losses accumulated over years, not sudden; no immediate sell-off required

What's implied:

Impact: Creates undue panic about present economic stability, prompting hasty judgments on bank risks.

Sources & References

External sources consulted for this analysis

https://fortune.com/2025/05/14/banks-500-billion-unrealized-losses-stagflation-svb-crisis/

https://www.financialresearch.gov/the-ofr-blog/2025/05/15/the-state-of-banks-unrealized-securities-losses/

https://www.mitrade.com/insights/news/live-news/article-3-420775-20241020

https://finance.yahoo.com/news/u-banks-sitting-750-billion-140013188.html

https://www.reddit.com/r/economy/comments/1kzvb4t/us_banks_are_now_sitting_on_413_billion_in/

https://www.ainvest.com/news/bloomberg-banks-sitting-395-billion-unrealized-losses-mark-market-write-downs-bonds-securities-2510/

https://www.threads.com/@fluent.in.finance/post/DP6WZl1Ecka/us-banks-are-now-sitting-on-395-billion-in-unrealized-losseswho-remembers-when-b

https://www.ainvest.com/news/bloomberg-banks-sitting-395-billion-unrealized-losses-mark-market-write-downs-bonds-securities-2510/

https://www.threads.com/@fluent.in.finance/post/DP6WZl1Ecka/us-banks-are-now-sitting-on-395-billion-in-unrealized-losseswho-remembers-when-b

https://deepnewz.com/economics/us-banks-hold-413-billion-unrealized-losses-fed-reports-1-trillion-losses-new-d5d41c9a

https://timesofindia.indiatimes.com/technology/tech-news/experts-sound-alarm-us-banks-sitting-on-500-billion-in-unrealized-losses-fear-a-repeat-of-silicon-valley-bank-like-collapse/articleshow/121194423.cms

https://medium.com/@Pragoz/us-banks-in-crisis-650-billion-in-losses-a3e0896aec93

https://www.cryptopolitan.com/ar/u-s-banks-unrealized-losses-soar-to-7-times-2008-crisis-levels/

https://www.fau.edu/newsdesk/articles/unrealized-losses-surge-interest-rates-banks

https://x.com/FluentInFinance/status/1639310753734836228

https://x.com/FluentInFinance/status/1634587484834152448

https://x.com/FluentInFinance/status/1634437898282975232

https://x.com/FluentInFinance/status/1650187809351761920

https://x.com/FluentInFinance/status/1640605600173178882

https://x.com/FluentInFinance/status/1655220125367169025

https://www.fdic.gov/news/speeches/2025/fdic-quarterly-banking-profile-second-quarter-2025

https://www.reddit.com/r/EconomyCharts/comments/1ngjstw/us_banks_are_now_sitting_on_395_billion_in/

https://www.financialresearch.gov/the-ofr-blog/2025/05/15/the-state-of-banks-unrealized-securities-losses/

https://www.fau.edu/newsdesk/articles/concerns-banking-stability-unrealized-losses.php

https://business.fau.edu/departments/finance/banking-initiative/unrealized-losses-investment-securities/

https://www.threads.com/@fluent.in.finance/post/DP6WZl1Ecka/us-banks-are-now-sitting-on-395-billion-in-unrealized-losseswho-remembers-when-b

https://www.ainvest.com/news/bloomberg-banks-sitting-395-billion-unrealized-losses-mark-market-write-downs-bonds-securities-2510/

https://www.ainvest.com/news/bloomberg-banks-sitting-395-billion-unrealized-losses-mark-market-write-downs-bonds-securities-2510/

https://www.threads.com/@fluent.in.finance/post/DP6WZl1Ecka/us-banks-are-now-sitting-on-395-billion-in-unrealized-losseswho-remembers-when-b

https://seekingalpha.com/news/4489219-us-banks-trim-paper-losses-to-395b-in-q2-fdic-says

https://www.bloomberg.com/news/articles/2025-09-04/smaller-banks-tackle-395-billion-bond-headache-with-share-sales

https://dailyhodl.com/2025/05/30/413200000000-in-unrealized-losses-hit-us-banks-as-fdic-warns-rising-rates-adding-pressure/

https://economictimes.indiatimes.com/news/international/us/u-s-banks-sitting-on-500-billion-in-unrealized-losses-as-stagflation-fears-raise-alarms-of-a-repeat-of-silicon-valley-bank-like-collapse/articleshow/121192873.cms

https://www.noradarealestate.com/blog/how-many-banks-have-failed-in-the-us-in-2025/

https://x.com/FluentInFinance/status/1639310753734836228

https://x.com/FluentInFinance/status/1634437898282975232

https://x.com/FluentInFinance/status/1650187809351761920

https://x.com/FluentInFinance/status/1634587484834152448

https://x.com/FluentInFinance/status/1645105768109047813

https://x.com/FluentInFinance/status/1640605600173178882

Want to see @FluentInFinance's track record?

View their credibility score and all analyzed statements