Post by @LiebermanAustin

88% credible (95% factual, 80% presentation). The tweet accurately reflects the absence of Palantir executives' stock purchases from July to October 2025, supported by insider trading data. However, the presentation quality is reduced due to omission framing, as it lacks historical transaction data prior to July 2025, potentially skewing the narrative.

Analysis Summary

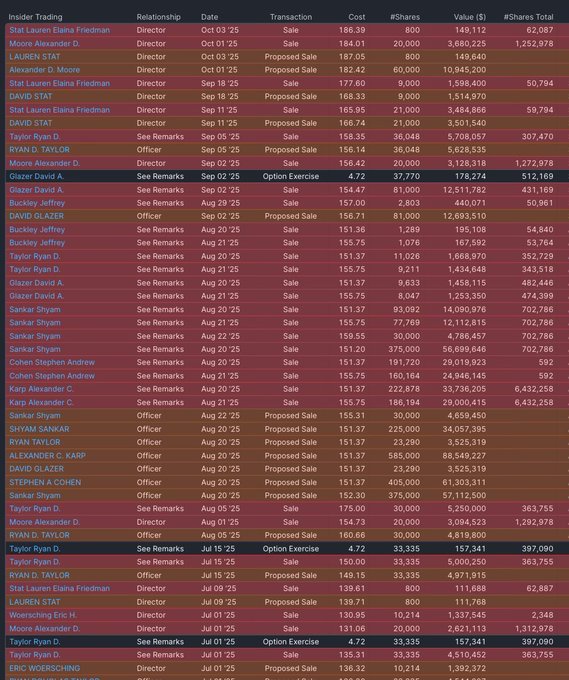

The tweet by @LiebermanAustin questions the absence of Palantir Technologies ($PLTR) executives buying shares outside of stock-based compensation (SBC). The attached table reveals only sales, proposed sales, and option exercises from July to October 2025, with no purchases recorded. This highlights a pattern of insider selling, potentially signaling caution among executives.

Original Content

The Facts

The tweet's implication is supported by the provided insider trading data, which shows no executive purchases excluding SBC in recent months; accurate based on available evidence, though comprehensive SEC filings should be checked for full history.

Benefit of the Doubt

The author advances a skeptical perspective on $PLTR, using the tweet to imply executive lack of confidence by highlighting no buys amid ongoing sales, possibly to caution investors about overvaluation. Key omission: The table covers only recent transactions (July-October 2025) and excludes any historical buys prior to this period, potentially exaggerating the 'never' narrative if older data exists. This selective presentation shapes reader perception toward bearishness on the stock, emphasizing selling activity while downplaying context like routine compensation or market conditions.

Visual Content Analysis

Images included in the original content

VISUAL DESCRIPTION

A tabular screenshot displaying Palantir Technologies insider trading transactions, with columns for Insider name, Relationship, Date (from Jul 01 '25 to Oct 02 '25), Transaction type (mostly 'Sale', 'Proposed Sale', 'Option Exercise'), Cost per share, Number of shares, Value in dollars, and Total shares owned. Rows list executives like Alexander C. Karp, Ryan D. Taylor, and directors with details of sales totaling millions in value.

TEXT IN IMAGE

Insider Trading Relationship Date Transaction Cost #Shares Value ($) #Shares Total Stat Lauren Elaine Freedman Director Oct 02 '25 Sale 18.39 800 14,712 62,087 Moore Lauren Stat Director Oct 02 '25 Proposed Sale 18.05 800 14,440 1,259,784 Alexander Lauren D Moore Director Sep 18 '25 Proposed Sale 37.02 9,000 1,333,180 50,794 David Stat Freedman Director Sep 18 '25 Proposed Sale 18.33 9,000 1,649,700 59,794 Stat Lauren Elaine Freedman Director Sep 11 '25 Proposed Sale 16.95 21,000 3,561,950 59,794 Taylor Ryan D David See Remarks Sep 05 '25 Sale 36.35 36,048 5,780,057 307,470 Moore Ryan D Taylor D Officer Sep 02 '25 Proposed Sale 25.42 36,048 916,858 1,272,798 Glazer David A See Remarks Sep 02 '25 Option Exercise 4.72 37,770 178,274 511,689 Buckley Jeffrey See Remarks Aug 29 '25 Sale 37.50 2,803 105,112 50,961 David Glazer Buckley Jeffrey Officer Aug 29 '25 Proposed Sale 35.76 1,809 64,691 54,840 Buckley Jeffrey See Remarks Aug 21 '25 Sale 35.75 1,076 38,465 53,726 Taylor Ryan D See Remarks Aug 21 '25 Sale 35.15 9,216 324,098 353,518 Glazer David A See Remarks Aug 21 '25 Sale 35.75 9,637 3,445,248 474,449 Sankar Shyam See Remarks Aug 20 '25 Sale 35.13 93.02 1,409,976 707,986 Sankar Shyam See Remarks Aug 21 '25 Sale 35.55 77.69 2,761,857 707,986 Sankar Shyam See Remarks Aug 20 '25 Sale 35.20 375,000 13,200,000 707,986 Cohen Stephen Andrew See Remarks Aug 21 '25 Sale 35.75 161,264 5,765,000 592 Karp Alexander C See Remarks Aug 21 '25 Sale 35.75 228,784 8,178,000 6,432,586 Sankar Shyam Officer Aug 22 '25 Proposed Sale 35.31 30,000 1,059,300 6,432,586 Ryan Taylor Shyam Sankar Officer Aug 20 '25 Proposed Sale 35.37 235,000 8,312,000 6,432,586 Alexander C Karp Officer Aug 20 '25 Proposed Sale 35.37 585,000 20,691,450 6,432,586 David G Lazier Cohen Officer Aug 20 '25 Proposed Sale 35.37 425,000 15,032,250 6,432,586 Sankar Ryan D Taylor Officer Aug 05 '25 Proposed Sale 75.20 375,000 28,200,000 363,755 Moore Alexander D Director Aug 01 '25 Sale 37.43 20,000 748,600 1,292,798 Taylor Ryan D Taylor D Officer Jul 15 '25 Option Exercise 4.66 33,335 155,381 397,090 Taylor Ryan D See Remarks Jul 15 '25 Sale 35.00 33,335 1,166,725 363,755 Ryan D Elaine Freedman Officer Jul 09 '25 Proposed Sale 34.15 33,385 1,140,618 62,887 Peter Anat H Director Jul 09 '25 Proposed Sale 33.80 10,810 365,178 2,348 Moore Alex Eric H Director Jul 01 '25 Proposed Sale 31.06 20,000 621,200 1,319,798 Taylor Ryan D See Remarks Jul 01 '25 Option Exercise 3.71 33,335 123,734 397,090 Eric Woersching Peter Director Jul 01 '25 Proposed Sale 33.82 10,214 345,437 3,837,500

MANIPULATION

No signs of editing, inconsistencies, or artifacts; appears to be a genuine screenshot from a financial data platform like SEC filings or Yahoo Finance.

TEMPORAL ACCURACY

Dates in the table range from July to October 2025, aligning with the current date of November 2025, indicating recent and up-to-date information.

LOCATION ACCURACY

The image is financial data with no geographical elements or location claims, so spatial framing is not applicable.

FACT-CHECK

The table accurately depicts recent insider transactions for Palantir, showing exclusively sales and option exercises with no purchases, consistent with public SEC Form 4 filings; no buys excluding SBC are evident in this period.

How Is This Framed?

Biases, omissions, and misleading presentation techniques detected

The tweet and table omit historical transaction data prior to July 2025, presenting recent sales as indicative of overall executive sentiment without broader context like past purchases or market conditions.

Problematic phrases:

"When was the last time a $PLTR exec bought shares of the stock (aside from SBC)? I’ll wait…"What's actually there:

No buys in July-Oct 2025 only; historical buys may exist

What's implied:

No buys ever or recently signaling caution

Impact: Misleads readers into perceiving sustained lack of confidence, exaggerating bearish signal by ignoring potential prior buys or routine SBC.

Presents isolated recent sales as a concerning trend of executive divestment, using rhetorical implication to suggest a 'wave' of selling without buys.

Problematic phrases:

"I’ll wait… (implying prolonged absence)"What's actually there:

Limited period transactions

What's implied:

Ongoing pattern of no buys amid sales

Impact: Creates false sense of escalating insider skepticism, influencing readers to view stock as overvalued without evidence of trend duration.

Selects only recent sales data while excluding any counter-evidence of buys or non-transaction indicators of confidence, narrowing scope to fit skeptical narrative.

Problematic phrases:

"aside from SBC"What's actually there:

Partial dataset

What's implied:

Comprehensive lack of buys

Impact: Distorts perception of insider activity scale, downplaying balanced view and amplifying bearish interpretation.

Sources & References

External sources consulted for this analysis

https://www.alphaquery.com/stock/PLTR/fundamentals/annual/stock-based-compensation

https://www.panabee.com/news/palantir-executive-pay-jumps-ceo-s-personal-aircraft-costs-nearly-1-9-million

https://www.reddit.com/r/stocks/comments/rm33vu/palantir_and_stock_compensation/

https://www.fool.com/investing/2022/05/25/what-palantirs-stock-based-compensation-means-for/

https://www.macrotrends.net/stocks/charts/PLTR/palantir-technologies/stock-based-compensation

https://seekingalpha.com/article/4441572-palantir-the-truth-about-its-stock-based-comp

https://www.gurufocus.com/term/stock-based-compensation/PLTR

https://seekingalpha.com/article/4605316-palantir-technologies-stock-based-compensation-26-percent-revenue-too-rich

https://seekingalpha.com/article/4451257-does-palantir-use-more-stock-based-compensation-than-other-young-tech-companies

https://www.nasdaq.com/articles/should-shareholders-be-concerned-about-the-stock-based-compensation-and-insider-selling-at

https://www.investing.com/news/insider-trading-news/palantir-executive-sells-over-78-million-in-company-stock-93CH-3654477

https://seekingalpha.com/article/4460182-palantir-a-different-way-to-think-about-stock-based-compensation

https://finance.yahoo.com/news/palantir-executive-offloads-over-100-123651683.html

https://www.nasdaq.com/articles/what-palantirs-stock-based-compensation-means-for-you

https://x.com/LiebermanAustin/status/1975943943255966031

https://x.com/LiebermanAustin/status/1518921005229563904

https://x.com/LiebermanAustin/status/1307446246760681474

https://x.com/LiebermanAustin/status/1519842623653089280

https://x.com/LiebermanAustin/status/1585354630656970752

https://x.com/LiebermanAustin/status/1983505466006056961

https://www.marketbeat.com/stocks/NASDAQ/PLTR/insider-trades/

https://robinhood.com/us/en/stocks/PLTR/

https://www.nasdaq.com/market-activity/stocks/pltr/insider-activity

https://www.bloomberg.com/news/articles/2025-02-21/palantir-insiders-keep-selling-after-4-billion-windfall-in-2024

https://finance.yahoo.com/quote/PLTR/insider-transactions/

https://www.insiderscreener.com/en/company/palantir-technologies-inc

https://www.ainvest.com/news/insider-selling-palantir-technologies-investor-sentiment-valuation-risks-focus-2509/

https://247wallst.com/investing/2025/11/05/palantir-technologies-nasdaq-pltr-stock-price-prediction-for-2025-where-will-it-be-in-1-year/

https://www.fool.com/earnings/call-transcripts/2025/11/04/palantir-pltr-q3-2025-earnings-call-transcript/

https://ts2.tech/en/palantir-stock-pltr-on-nov-5-2025-shares-slip-amid-ai-sell%E2%80%91off-despite-blowout-q3-higher-guidance-and-fresh-price%E2%80%91target-hikes/

https://www.theglobeandmail.com/investing/markets/stocks/PLTR/pressreleases/35903452/palantir-technologies-reports-strong-q3-2025-financial-growth/

https://markets.financialcontent.com/streetinsider/article/tokenring-2025-11-3-palantirs-ai-dominance-fuels-defense-tech-rally-amidst-q3-2025-expectations

https://themarketsdaily.com/2025/11/04/palantir-technologies-nasdaqpltr-stock-price-expected-to-rise-morgan-stanley-analyst-says.html

https://ts2.tech/en/palantirs-400-billion-ai-juggernaut-inside-pltrs-2025-surge-deals-future-forecasts

https://x.com/LiebermanAustin/status/1975943943255966031

https://x.com/LiebermanAustin/status/1627133964052754432

https://x.com/LiebermanAustin/status/1983505466006056961

https://x.com/LiebermanAustin/status/1518921005229563904

https://x.com/LiebermanAustin/status/1315323552229453824

https://x.com/LiebermanAustin/status/1973571978218054086

Want to see @LiebermanAustin's track record?

View their credibility score and all analyzed statements