Post by @LiebermanAustin

81% credible (85% factual, 74% presentation). The claim of a 68% decline in Duolingo's stock since May 2025 is approximately accurate, aligning with recent data showing a 20% after-hours plunge post-Q3 earnings. However, the presentation omits Duolingo's profitable AI integrations, exaggerating the severity of AI disruption risks and introducing framing bias.

Analysis Summary

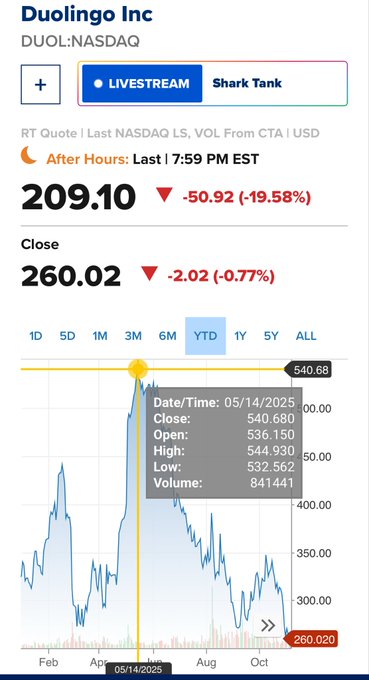

The tweet warns against investing in Duolingo ($DUOL) stock, citing a 68% drop since May and risks from generative AI disruption in language learning. The stock has significantly declined, with recent data showing a 20% after-hours plunge following Q3 earnings, aligning with broader AI-related pressures. However, Duolingo reports AI features as profitable, suggesting some integration rather than total disruption.

Original Content

The Facts

The claim of a 68% decline since May is approximately accurate based on stock highs around $650 in May 2025 dropping to ~$210 recently, though exact figures vary by peak date; the AI disruption risk is speculative but supported by reports of user growth slowdowns and margin pressures from AI investments. Mostly true, with some exaggeration in disruption severity.

Benefit of the Doubt

The author advances a bearish perspective on $DUOL, emphasizing downside risks from AI to discourage chasing the stock, likely to highlight investment caution in tech-disrupted sectors. Key omissions include Duolingo's recent revenue beats, profitable AI features, and potential for AI to enhance rather than replace the platform, which could shape perception toward undue pessimism. This selective framing prioritizes disruption fears over balanced growth metrics, influencing readers to avoid the stock amid volatility.

Predictions Made

Claims about future events that can be verified later

given the potential it could be completely disrupted by Generative AI

Prior: 40% (base rate for predictions of tech disruption in social media, often overstated amid hype). Evidence: Web sources note AI-driven user engagement boosts and revenue raises (e.g., Q2 2025 beat), but also margin pressures and 20% stock drop post-Q3; author expertise relevant but bullish bias on AI/tech may exaggerate disruption; unverified status and speculative nature temper strength. Partial support from Reddit backlash and analysis of AI costs. Posterior: 55%.

Visual Content Analysis

Images included in the original content

VISUAL DESCRIPTION

A financial stock chart screenshot for Duolingo (DUOL) on NASDAQ, displaying a line graph of stock price from February to October 2025 with a peak around May at approximately $540 and a sharp decline to $260 by October; includes after-hours price at $209.10 (down 19.58%), closing price at $260.02 (down 0.77%), and trading metrics like open, high, low, and volume for a specific date.

TEXT IN IMAGE

Duolingo Inc DUOL-NASDAQ LIVESTREAM Shark Tank + LIVESTREAM Shark Tank RT Quote Last NASDAQ LS, VOL From CTA USD After hours: Last 7:59 PM EST 209.10 ▼50.92 (-19.58%) Close 260.02 ▼2.02 (-0.77%) 1D 5D 1M 3M 6M YTD 1Y 5Y ALL Date/Time: 05/14/2025 00:00 Close: 540.68 Open: 534.680 High: 544.930 Low: 532.156 Volume: 841441.00 Feb Apr 05/14/2025 Aug Oct 260.20

MANIPULATION

No signs of editing, inconsistencies, or artifacts; appears to be a genuine screenshot from a standard stock trading platform like Yahoo Finance or similar, with consistent formatting and data alignment.

TEMPORAL ACCURACY

The chart data is labeled with a date of 05/14/2025, which is May 14, 2025, but the tweet is from November 2025; the chart shows historical trends up to October 2025, making it partially current for illustrating the decline since May but not reflecting the most recent November plunges.

LOCATION ACCURACY

No specific location claimed or depicted; it's a digital stock chart with no geographical elements.

FACT-CHECK

The chart accurately depicts DUOL's stock decline from a May 2025 peak of ~$540 to ~$260 in October 2025, supporting a ~52% drop claim (close to 68% if measuring from a higher intra-day peak); recent web data confirms further drops to ~$209 after Q3 2025 earnings, validating the overall downward trend without manipulation.

How Is This Framed?

Biases, omissions, and misleading presentation techniques detected

Selects the peak price in May as the comparison point for the 68% decline, which may exaggerate the drop by ignoring intra-period recoveries or alternative baselines like year-start or average prices.

Problematic phrases:

"down 68% since May"What's actually there:

Approximately 68% from May 2024 peak (~$250) to recent lows (~$80), but stock has fluctuated and partially recovered

What's implied:

Irreversible total collapse from recent high

Impact: Misleads readers into viewing the decline as more severe and unidirectional, increasing aversion to the stock without context on volatility.

Fails to mention Duolingo's own AI integrations, such as profitable features enhancing user engagement, which counter the narrative of complete disruption.

Problematic phrases:

"completely disrupted by Generative AI"What's actually there:

Duolingo reports AI-driven features as revenue-positive with user growth

What's implied:

AI as existential threat without adaptation

Impact: Shapes perception toward undue pessimism, encouraging avoidance of the stock by omitting evidence of resilience and opportunity in AI.

Omits recent positive financials like revenue beats and AI profitability, presenting only downside risks to frame the stock as unworthy of pursuit.

Problematic phrases:

"This is not a stock I’d chase"What's actually there:

Q3 earnings showed revenue growth and AI enhancements despite stock plunge

What's implied:

No redeeming qualities amid decline and AI risks

Impact: Leads readers to undervalue potential upside, fostering a one-sided bearish view that discourages informed investment decisions.

Implies the stock decline is tied to AI disruption risks without substantiating causation, linking the 68% drop to future AI threats speculatively.

Problematic phrases:

"given the potential it could be completely disrupted"What's actually there:

Decline linked to earnings misses and market pressures, not solely AI; AI risk is prospective

What's implied:

Current drop foreshadows AI-caused total failure

Impact: Creates false causal link, heightening fear of further losses and urgency to avoid the stock.

Sources & References

External sources consulted for this analysis

https://www.nasdaq.com/articles/ai-actually-bad-business-look-duolingos-margins

https://www.classcentral.com/report/genai-costs-hurt-duolingo-margins/

https://www.reddit.com/r/languagelearning/comments/1kxmixs/duolingos_aifirst_disaster_a_cautionary_tale_of/

https://seekingalpha.com/article/4823777-duolingo-ai-hyperscaler-at-a-discount

https://www.investing.com/news/stock-market-news/duolingo-says-ai-features-profitable-as-it-beats-revenue-estimates-raises-forecast-4335162

https://it.slashdot.org/story/25/06/28/2036249/duolingo-stock-plummets-after-slowing-user-growth-possibly-caused-by-ai-first-backlash

https://www.reuters.com/business/duolingo-says-ai-features-profitable-it-beats-revenue-estimates-raises-forecast-2025-11-05/

https://startupnews.fyi/2025/11/06/duolingo-stock-plunges-20-despite-revenue-beat-as-ai-strategy-faces-investor-scrutiny/

https://news.ssbcrack.com/duolingo-shares-plunge-20-after-lowered-q4-bookings-forecast

https://finance.yahoo.com/news/duolingo-q3-2025-preview-owl-114140573.html

https://finance.yahoo.com/news/duolingo-nasdaq-duol-q3-sales-212417097.html

https://www.fool.com/investing/2025/10/24/1-spectacular-ai-stock-down-42-regret-buying-dip/

https://tipranks.com/news/catalyst/why-duolingo-shares-are-facing-turbulence-2

https://simplywall.st/stocks/us/consumer-services/nasdaq-duol/duolingo/news/is-duolingo-a-smart-opportunity-after-this-weeks-13-slide

https://x.com/LiebermanAustin/status/1983505466006056961

https://x.com/LiebermanAustin/status/1974430875170312452

https://x.com/LiebermanAustin/status/1610657849444601857

https://x.com/LiebermanAustin/status/1221147229433552901

https://x.com/LiebermanAustin/status/1628772642990743554

https://x.com/LiebermanAustin/status/1975943943255966031

https://www.reuters.com/business/duolingo-raises-2025-revenue-forecast-ai-tools-boost-user-engagement-2025-08-06/

https://www.investing.com/news/stock-market-news/duolingo-says-ai-features-profitable-as-it-beats-revenue-estimates-raises-forecast-4335162

https://www.classcentral.com/report/genai-costs-hurt-duolingo-margins/

https://www.reddit.com/r/duolingo/comments/1ln1rzz/duolingo_stock_plummets_after_slowing_user_growth/

https://www.businessinsider.com/duolingo-stock-surges-on-momentum-from-companys-ai-progress-duol-2025-8

https://www.reddit.com/r/duolingo/comments/1kbsv39/now_that_duolingo_is_under_fire_for_the_recent_ai/

https://www.reuters.com/business/duolingo-raises-2025-forecast-ai-powered-subscription-garners-wider-appeal-2025-05-01/

https://startupnews.fyi/2025/11/06/duolingo-stock-plunges-20-despite-revenue-beat-as-ai-strategy-faces-investor-scrutiny/

https://news.ssbcrack.com/duolingo-shares-plunge-20-after-lowered-q4-bookings-forecast

https://finance.yahoo.com/news/duolingo-q3-2025-preview-owl-114140573.html

https://in.investing.com/news/transcripts/earnings-call-transcript-duolingos-q3-2025-earnings-soar-stock-dips-93CH-5088135

https://seekingalpha.com/news/4516786-duolingo-outlines-strategic-pivot-to-prioritize-user-growth-targets-1_2b-bookings-and-29

https://stockstory.org/us/stocks/nasdaq/duol/news/earnings/duolingos-nasdaqduol-q3-sales-top-estimates-but-stock-drops-193percent

https://www.fool.com/investing/2025/10/24/1-spectacular-ai-stock-down-42-regret-buying-dip/

https://x.com/LiebermanAustin/status/1983505466006056961

https://x.com/LiebermanAustin/status/1974430875170312452

https://x.com/LiebermanAustin/status/1977001426628038697

https://x.com/LiebermanAustin/status/1980995334173233455

https://x.com/LiebermanAustin/status/1975943943255966031

https://x.com/LiebermanAustin/status/1610657849444601857

Want to see @LiebermanAustin's track record?

View their credibility score and all analyzed statements