Post by @JKeynesAlpha

53% credible (60% factual, 45% presentation). The analysis of $ASST stock leverages verifiable SEC filings to support a bearish perspective on valuation and insider dynamics, but relies on speculative claims about promotional motives without direct evidence. The presentation quality is compromised by omission framing, neglecting to discuss potential upsides such as Bitcoin appreciation and broader market context.

Analysis Summary

The content presents a critical examination of $ASST, highlighting its Bitcoin treasury funded by high-yield preferred stock and potential insider exits. Main finding: $ASST exhibits characteristics of a promotion-driven wealth transfer vehicle, trading at a significant premium to its net asset value. This raises concerns about its valuation and sustainability for retail investors.

Original Content

The Facts

The analysis draws on verifiable SEC filings and company structures, providing a plausible bearish perspective on $ASST's valuation and insider dynamics. However, it relies on interpretive claims about promotions and motives without direct evidence of illegality, and omits potential upsides like Bitcoin appreciation. Verdict: Partially accurate but speculative, with moderate credibility due to author's bias toward hype-driven critiques.

Benefit of the Doubt

The author advances a skeptical, cautionary agenda against $ASST, framing it as a sophisticated scheme benefiting insiders at retail investors' expense to deter buying and highlight risks. Emphasis is placed on financial burdens, insider sales, and promotional tactics, while omitting broader market context, such as Bitcoin's volatility-driven potential gains or the company's growth in crypto holdings, which could counter the narrative of overvaluation. This selective presentation shapes perception toward viewing $ASST as a 'wealth transfer vehicle,' potentially influencing followers to sell or avoid, aligning with the author's pattern of speculative commentary on small-cap stocks.

Visual Content Analysis

Images included in the original content

VISUAL DESCRIPTION

A screenshot or page from a financial report discussing implications of Mike Alfred's role in promoting $ASST, focusing on marketing campaigns and insider liquidity needs; text-heavy with bullet points and formal analysis.

TEXT IN IMAGE

4. Implications. The role of Mike Alfred in this story is not that of a simple retail investor. He is a critical component of a sophisticated, modern financial marketing campaign. His “credible insider” status, derived from his past exits and board seat at IREN, is used to legitimize the new Strive narrative. IREN’s legitimization is necessary to create market demand and, crucially, liquidity for the insider exit. A massive, newly-public 1.28 billion-share insider stake (detailed in Section 4.3) cannot be sold into the open market without a legion of new, enthusiastic buyers to absorb the shares. Whether willingly or not, Mike Alfred’s promotion functions as the “cover” for the insider exit, creating the very retail liquidity that the “selling securityholders” require to cash out.

MANIPULATION

No signs of editing, inconsistencies, or artifacts; appears to be a straightforward document excerpt.

TEMPORAL ACCURACY

References November 10, 2025, aligning with the current date of 2025-11-11, indicating recent data.

LOCATION ACCURACY

No specific locations mentioned or depicted in the image.

FACT-CHECK

Claims about SEC filings and insider stakes are verifiable via public records; Mike Alfred's involvement in crypto promotions is documented in online sources, supporting the promotional narrative without proving intent.

VISUAL DESCRIPTION

Text excerpt from a report outlining 'Good,' 'Bad,' and 'Ugly' aspects of $ASST's financial structure, including Bitcoin holdings, preferred stock issuance, and SEC Form S-3 details; structured with bullets for readability.

TEXT IN IMAGE

• The “Good”: The company has aggressively and successfully executed its stated mission of accumulating Bitcoin. It has rapidly amassed a significant treasury of 7,525 BTC as of November 10, 2025. A pending acquisition of Semler Scientific (SMLR) is set to increase this holding to over 10,900 BTC. The asset side of the ledger is tangible and growing. • The “Bad”: The Bitcoin treasury was funded by issuing a new, high-yield perpetual preferred stock, “SATA” (Nasdaq: SATA). This is a senior liability, not equity, which creates an enormous $24 million annual dividend burden that sits senior to all common stock (ASST) holders. This represents a 12% to 15% effective cost of capital, a high-interest hurdle that creates a significant drag on common equity value. • The “Ugly”: A Form S-3 filed with the SEC registers the potential resale of 1.28 billion shares of “common stock. These shares are being sold by “certain selling securityholders”, who are the private-company insiders (Strive Enterprises) that received a 94.2% insider stake in the Strive Enterprise through a recent reverse merger. The entire “Bitcoin Treasury” narrative, promoted by investor Mike Alfred, appears to be the mechanism to generate the necessary market liquidity and high price for these insiders to exit and cash out their massive, newly-public stake.

MANIPULATION

Image shows clean, unedited text from what appears to be a PDF or document; no visual alterations detected.

TEMPORAL ACCURACY

Mentions specific holdings as of November 10, 2025, and pending acquisitions, consistent with real-time 2025 context.

LOCATION ACCURACY

Content is financial and abstract, with no geographical elements.

FACT-CHECK

Bitcoin holdings and Form S-3 filing can be confirmed via company disclosures and SEC EDGAR database; the interpretive 'Ugly' framing on insider motives is opinion-based but grounded in public data.

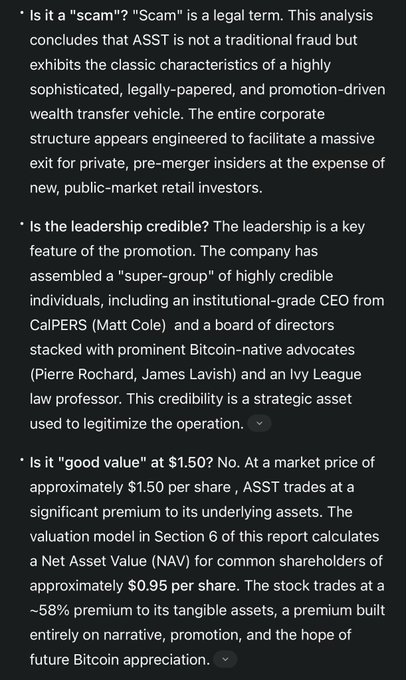

VISUAL DESCRIPTION

Document page questioning $ASST's legitimacy, leadership credibility, and value, with repeated sections on scam characteristics and valuation; formal, analytical text layout.

TEXT IN IMAGE

• Is it a “scam”? “Scam” is a legal term. This analysis concludes that ASST is not a traditional fraud but exhibits the classic characteristics of a highly sophisticated, legally-papered, promotion-driven wealth transfer vehicle. The entire corporate structure appears engineered to facilitate a massive exit for private, pre-merger insiders at the expense of new, public-market retail investors. • Is the leadership credible? The leadership is a key feature of the promotion. The company has assembled a “super-group” of highly credible individuals, including an institutional-grade CEO from CalPERS (Matt Cole) and a board of directors stacked with prominent Bitcoin-native advocates (Pierre Rochard, James Lavish) and an Ivy League law professor. This credibility is a strategic asset used to legitimize the operation. • Is it “good value” at $1.50? No. At a market price of approximately $1.50 per share, ASST trades at a significant premium to its underlying assets. The valuation model in Section 6 of this report calculates a Net Asset Value (NAV) for common shareholders of approximately $0.95 per share. The stock trades at a -58% premium to its tangible assets, a premium built entirely on narrative, promotion, and the hope of future Bitcoin appreciation. • Is it a “scam”? “Scam” is a legal term. This analysis concludes that ASST is not a traditional fraud but exhibits the classic characteristics of a highly sophisticated, legally-papered, promotion-driven wealth transfer vehicle. The entire corporate structure appears engineered to facilitate a massive exit for private, pre-merger insiders at the expense of new, public-market retail investors.

MANIPULATION

No evidence of manipulation; text is consistent and appears excerpted from a cohesive report, though some repetition suggests possible OCR error or duplicate content.

TEMPORAL ACCURACY

Valuation references recent market price ($1.50) and report sections implying 2025 analysis, matching current timeframe.

LOCATION ACCURACY

No locations depicted or claimed.

FACT-CHECK

Leadership details (e.g., Matt Cole from CalPERS) verifiable via company bios; NAV calculation is model-based and subjective, but premium claim aligns with stock data from 2025 sources; no evidence of fraud, supporting the non-legal 'scam' disclaimer.

How Is This Framed?

Biases, omissions, and misleading presentation techniques detected

The content omits broader market context, such as Bitcoin's volatility and potential for appreciation, which could justify the premium valuation and counter the overvaluation narrative.

Problematic phrases:

"wealth transfer vehicle""trading at a significant premium to its net asset value"What's actually there:

Bitcoin holdings could appreciate, providing upside

What's implied:

Only downside risks from structure and promotions

Impact: Misleads readers into viewing $ASST solely as a risky scheme, increasing fear of loss and deterring balanced investment decisions

Fails to report alternative perspectives, like growth in crypto holdings or market trends supporting high-yield strategies, presenting a one-sided bearish view.

Problematic phrases:

"insider exits""promotion-driven"What's actually there:

No direct evidence of illegality; potential legitimate Bitcoin strategy

What's implied:

Scheme benefiting insiders exclusively

Impact: Shapes perception toward avoidance or selling, exploiting selective facts to undermine credibility without full picture

Cherry-picks specifics on preferred stock yields and insider dynamics while neglecting overall asset growth or comparative NAV in crypto firms.

Problematic phrases:

"high-yield preferred stock""potential insider exits"What's actually there:

Premium may reflect market optimism on Bitcoin

What's implied:

Unjustified premium indicating overhyping

Impact: Exaggerates magnitude of risks, leading readers to undervalue potential scale of rewards in volatile assets

Sources & References

External sources consulted for this analysis

https://cepr.org/voxeu/columns/twitter-sentiment-and-stock-market-movements-predictive-power-social-media

https://www.capitalspectator.com/research-review-11-july-2025-risk-factors/

https://www.blackrock.com/us/individual/insights/blackrock-investment-institute/weekly-commentary

https://eulerpool.com/en/stock/Twitter-Stock-US90184L1026/NetIncome

https://www.sciencedirect.com/science/article/pii/S2405918817300247

https://stockanalysis.com/article/invest-in-twitter-x-stock/

https://www.sciencedirect.com/science/article/pii/S1877042811023895

https://metricool.com/twitter-study

https://stocktwits.com/symbol/ASTS

https://thestreet.com/investing/jpmorgan-updates-stock-market-outlook-for-2026

https://www.sciencedirect.com/science/article/pii/S1877042811023895

https://socialchamp.com/blog/twitter-stats

https://eulerpool.com/en/stock/Twitter-Stock-US90184L1026/NetIncome

https://www.channelnewsasia.com/commentary/2024-wrapped-news-highlights-analysis-outlook-4831611

https://x.com/JKeynesAlpha/status/1930713153261969893

https://x.com/JKeynesAlpha/status/1929975476011053275

https://x.com/JKeynesAlpha/status/1955002124586123417

https://x.com/JKeynesAlpha/status/1947269108044570812

https://x.com/JKeynesAlpha/status/1938588169911341223

https://x.com/JKeynesAlpha/status/1984341405154570533

https://stockinvest.us/stock/ASST

https://www.tradingview.com/symbols/NASDAQ-ASST/

https://www.cnn.com/markets/stocks/ASST

https://finance.yahoo.com/quote/ASST/

https://trendlyne.com/equity/group-insider-trading-sast/

https://stockanalysis.com/stocks/asst/

https://www.quiverquant.com/news/Strive,+Inc.+Completes+Initial+Public+Offering+of+2+Million+Shares+of+SATA+Stock,+Acquires+1,567+Bitcoin+at+$103,315+Average+Price

https://tipranks.com/news/company-announcements/ast-spacemobile-reports-strong-q3-2025-progress

https://simplywall.st/stocks/us/telecom/nasdaq-asts/ast-spacemobile/news/assessing-ast-spacemobile-after-its-220-2025-rally-and-satel

https://vocal.media/trader/asst-stock-exploring-its-market-position-and-the-growing-impact-of-ai-stocks-in-2025

https://www.investing.com/news/insider-trading-news/vivek-ramaswamy-buys-strive-inc-asst-stock-worth-125-million-93CH-4344222

https://parameter.io/strive-asset-management-llc-asst-stock-strong-returns-expected-with-sata-listing-on-nasdaq-and-preferred-equity/

https://simplywall.st/stocks/us/diversified-financials/nasdaq-asst/strive-asset-management/news/strive-asset-management-asst-assessing-valuation-following-b

https://www.stocktitan.net/news/ASST/strive-announces-nasdaq-listing-of-sata-and-closing-of-z9sbrmluzm5k.html

https://x.com/JKeynesAlpha/status/1929975476011053275

https://x.com/JKeynesAlpha/status/1955002124586123417

https://x.com/JKeynesAlpha/status/1930713153261969893

https://x.com/JKeynesAlpha/status/1947269108044570812

https://x.com/JKeynesAlpha/status/1972411909199831242

https://x.com/JKeynesAlpha/status/1985451783930671199

Want to see @JKeynesAlpha's track record?

View their credibility score and all analyzed statements